The World Bank asserts in its latest Country Climate and Development Report that Morocco could develop large-scale production of green hydrogen and its derivatives. By focusing on exports, the North African country could meet 4% of world demand by 2030 at the lowest price in terms of both production and transport.

According to the WB report, all predictions point to Morocco as the main destination for production. A study by the World Energy Council indicates that the world hydrogen market will represent 600 TWh in 2030 and 20,000 TWh in 2050. Organic Liquid Fertilizer

Taking these figures into account, Moroccan government sources predict that Morocco could account for 4 % of world demand by 2030. However, its share of the world market will decrease to 1 % in 2050 due to the increasing competitiveness of new countries.

According to IRESEN estimates, Morocco could produce between 13.9 and 30.1 TWh in 2030, of which 75% will go to exports, mainly to Europe, while the remaining amount will go to cover the Kingdom's domestic demand.

By 2050, the figures will increase to a production of between 153.9 and 307.1 TWh, with green hydrogen exports remaining the main demand application, followed by feedstock use and to a lesser extent as an energy source for decarbonising activities that are difficult to electrify.

It should be clarified that 70% of the export demand will be in the form of hydrogen, while the remaining 25% will be exported in the form of synthetic liquid fuel.

As for domestic demand, it is aimed at supplying the fertiliser sector and the refinery sector. In this sense, the public company OCP acts as a spearhead for the insertion of technology and innovation in the Moroccan industrial fabric, as H2 is a great opportunity that would allow it to reduce its production costs.

Internal demand as a source of energy, however, is not a path that shows optimistic expectations, given the lack of evacuation points, the high dependence on fossil fuels, the recent construction of coal-fired power plants, and the absence of decarbonisation plans for sectors other than those that require it for export to Europe, such as phosphates.

In July 2020, the European Union (EU) published a strategy that called for hydrogen to decarbonise sectors such as iron and steel production, industrial processes requiring high-temperature heat, aviation, maritime transport, long-distance road transport and heating of buildings.

Member States such as Spain, France, Portugal and Germany have published their own hydrogen roadmaps. In the summer of 2021, the EU and Morocco announced a green partnership on energy, climate and environment, covering many areas such as renewable energy infrastructure, energy efficiency and water use, with one of its main aspects being the production of green hydrogen.

Morocco's phosphate industry is another component influencing Morocco's positioning as a potential major player in the green hydrogen sector, as there is the possibility of creating ammonia using green hydrogen instead of natural gas.

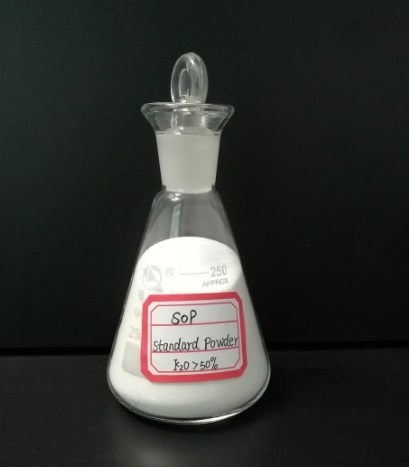

Although it has 75% of global phosphate reserves, Morocco relies heavily on imported ammonia (or grey ammonia), which is added to phosphoric acid to produce fertilisers. The OCP Group has therefore presented an ambitious investment programme for the period (2023-2027), which includes a target of producing 1 million tonnes of green ammonia per year.

Fossil fuels still account for more than 99% of the total energy consumption of maritime transport in 2021, according to the latest IEA data. This is why important players in the sector are moving to improve this situation.

Among these players is the large Danish shipping company Maersk, which has commissioned the first methanol-ready dual-fuel cargo vessel.

Maersk has commissioned another 24 vessels that can run on both conventional fuel oil and methanol, which it hopes will bring it closer to its goal of zero net emissions by 2050. Some reports foresee hundreds of similar ships by 2030, which could increase demand for the fuel.

The rail sector has traditionally been powered by diesel; however, the sector is taking a step away from harmful gases towards hydrogen in a bid to decarbonise the network.

It is estimated that by 2030, one in five newly purchased rail vehicles could run on green hydrogen and many countries have ambitious plans to introduce green hydrogen in the rail sector.

Some are already in operation, using hydrail, which employs a hybrid configuration of hydrogen fuel cells, batteries and electric traction motors.

One of the main drivers of this transformation is the French government through support to companies to carry out projects, including Alstom, which has carried out major projects in Morocco for the national railway company, ONCF.

Aviation accounts for 2-3% of global CO2 emissions and is considered the fastest growing source of greenhouse gas emissions. Air travel is expected to double in the next 15 years, which means that these figures will continue to rise.

The use of hydrogen fuel cells as a substitute for conventional aircraft propulsion systems offers an emission-free transport solution and has already been safely used in aviation for several years.

Hydrogen is estimated to have the potential to reduce CO2 emissions from aviation by up to 50% and is therefore an important technology for achieving the industry's decarbonisation targets.

Sustainable Aviation Fuel (SAF) includes fuel from a variety of sustainable sources, including green hydrogen. Suppliers are expected to start supplying SAF from 2025 and expect to be able to reach 85% of all aviation fuel at EU airports by 2050.

Hydrogen is included as part of this new fuel mix, and the International Air Transport Association (IATA) predicts that the aviation sector will require more than 100 million tonnes of hydrogen as fuel.

The question is how much this new clean energy will cost.

According to the ICEX Spain Export and Investment report on the market for green hydrogen and its derivatives in Morocco for the year 2023, there is still no competitive offer in the country, which prevents an analysis of market prices.

The price of green hydrogen can vary according to several factors, such as the location of the production plant, the costs of producing renewable electricity, the costs of electrolysers, and the costs of transporting and storing hydrogen.

According to the International Renewable Energy Agency, Morocco will have the third lowest green hydrogen production costs in 2050, between $0.70 and $1.40 per kilogram, behind China and Chile, and ahead of established countries such as Australia, Mexico, India and the US.

Thanks to hydrogen as a clean energy source, Morocco and North Africa offer Europe the solutions to decarbonise its industries, given the relatively low cost of both production due to the conditions and transport due to their proximity.

The issue of building or adapting transport infrastructures is currently being debated in the European Parliament. According to a Fraunhofer CINES report, hydrogen used as an energy source would have its lowest cost in the MENA region in Morocco.

For Mediterranean and Atlantic leaders, it wants to be the bridge of communication, information and understanding between cultures.

Phosphoric Acid Agriculture Grade Address: Calle Claudio Coello, 10. 28001 Madrid.Spain Telephone: +34 91 219 63 84 Email: atalayar@atalayar.com